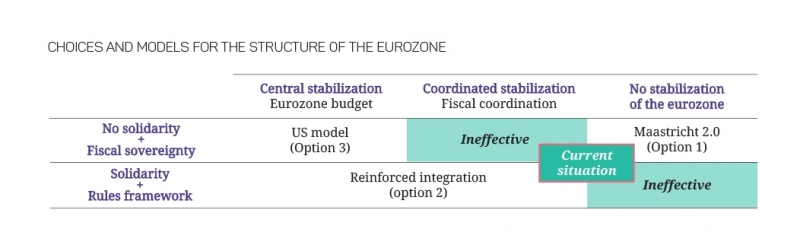

The first one would seek to return to the original principles, combined with complementary mechanisms to guarantee the credibility of the strict rule of non-solidarity on member states’ sovereign debt. It would reestablish fiscal sovereignty but with the risk of undoubtedly more frequent and costly public finance crises. The second model, which would consist of reinforced fiscal integration and joint liability regarding sovereign debt, would provide stability but imply placing national parliaments’ fiscal sovereignty under the control of a European legislative body. The third model would seek to replicate the US model of fiscal federalism to the eurozone: macroeconomic stabilization would be provided by a common budget, but member states would be solely responsible for their debts in return for wider latitude in defining their national fiscal policies.

Faced with the threat of breakup several times since the outbreak of the crisis in 2010, the euro area has responded with incremental adjustments aimed at buttressing its institutional structure. It created the European Stability Mechanism (ESM), providing financial assistance to Greece first and then to others to avoid a disorderly default that would have proven fatal for the European financial system. Having failed to prevent the excessive buildup of public debt, it responded by strengthening fiscal discipline, namely the Stability and Growth Pact (SGP). This came however at the cost of added complexity through more detailed rules and stronger penalties. The euro area also created a new procedure to identify, prevent and correct for macroeconomic imbalances, recognizing in the process that it had overlooked the consequences of its internal economic divergences. However, the corresponding mechanism has not been activated. The decision to create the Banking Union in 2012 was the last phase in this institutional overhaul. As yet unfinished, this wide-reaching reform consists of an integrated framework for supervising and resolving bank failures to prevent national banks from bringing down states when they fail during a crisis.

These incremental adjustments have taken the euro area further and further away from how it initially shared out different mandates. Monetary policy was to be entrusted to a single independent central bank, with the expectation that it would provide sufficient macroeconomic stabilization in the event of an economic shock affecting all member states equally (so-called “symmetric shocks”). In the event of an asymmetric shock, member states would be free to use their national budgets to provide stabilization on condition their deficits didn’t exceed 3% of GDP.[1] It was up to the member states to ensure their deficits and public debt would not jeopardize their ability to respond in the event of a crisis. The no-bailout clause of the Maastricht Treaty, which prohibits joint liability on member states’ public debt – but was widely interpreted as precluding financial assistance for a state having difficulty accessing the bond markets – was supposed to help enforce market discipline and prevent countries from pursuing policies that would put them at the risk of insolvency.

The reforms undertaken since 2010 to avert a breakup of the eurozone come at the cost of an incoherent institutional makeup. By coming to the aid of member states in difficulty and ruling out the possibility of a default, the euro area legitimized reinforcing fiscal discipline. However, a number of states today cannot shore up their economies because of the rules in place, which threatens their ability to handle a full-on crisis. The logic of the initial Maastricht setup, which intended to preserve the stabilization capacity of national budgets in the event of an asymmetric shock, is for all intents and purposes ineffective in several eurozone countries. Recent experience shows that in certain circumstances fiscal policy may need to buoy monetary policy action, but this could mean waiving the rules on fiscal discipline. To sum up, the framework for action initially attributed to fiscal policy is outdated despite its necessity for guaranteeing the zone’s integrity in a crisis.

Because the recent reforms have not fundamentally refashioned the balance struck by Maastricht, they have made the eurozone incoherent without resolving the problems undermining it. One of the reasons the eurozone is struggling to move forward today is because it has reached the limit of what can be done without reassessing the very institutional paradigm it is based on.

Member states are going to have to reexamine the Maastricht compromise and clarify the terms of the contract made between them if they are to build a more stable institutional base.

The choice can be summed up by the answer to two questions that determine the zone’s overall institutional structure:

- Are member states willing to abide by the common rules of fiscal discipline? If so, are they willing to take on a form of joint liability on their public debt? Or would they rather keep responsibility for public debt strictly national?

- Do member states want fiscal stabilization for the euro area as a whole? If so, do they want this to be centralized via a common budget? Or would they prefer it to be decentralized by coordinating national fiscal policies?

France’s position is not without its ambiguities and contradictions. Its unwavering support for an unclear 25-year-old concept – “economic government” – is no longer enough to deal with the current challenges. If it hopes to weigh in on the future of the euro area, France must take a stand with respect to these strategic choices. Once it has done so, it must accept the inherent trade-offs to maintain the coherence of the project as a whole. Only when French preferences have been clarified can it engage in dialogue with Berlin and our other partners.

Moreover, none of the available options can be implemented without addressing the issue of legacy debt, in particular that resulting from the financial crisis. This problem is in part responsible for the blockages preventing the eurozone from making progress towards a more coherent institutional structure. The temptation to deal with this obstacle is legitimate, but by focusing discussions on zero-sum games, it could well lead to an impasse. It is first necessary to flesh out the characteristics of a permanent system: only with a framework agreement on the objective will it be possible to resolve the problem of legacy debt.

[1] National budgets were to ensure stabilization in the event an economic shock hit one or a group of countries. On the other hand, if a shock were to hit the euro zone as a whole, monetary policy was also to act as a stabilizer.