At a time when the Eurozone is facing a shortfall of aggregate demand, related to the present economic climate, and major structural challenges in terms of competitiveness, reduction of the investment gap seems to be a well-balanced recommendation.

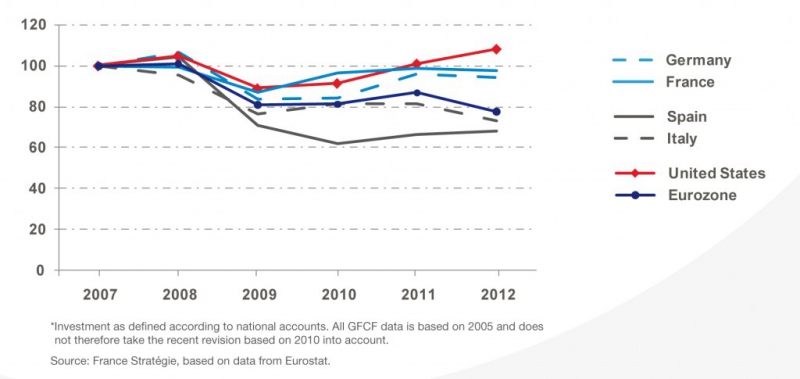

Between 2007 and 2013, in spite of an initial stage in which investment remained relatively healthy, the Eurozone increasingly lagged seriously behind the United States. Spain and Italy, in particular, have seen a very pronounced reduction in all investment components.

The situation is more di cult to assess with regard to France and Germany. Germany has shown chronic public underinvestment for many years, which has not been slowed by the crisis, quite the reverse. France, on the other hand, is faced with poor investment: insu cient formation of highquality productive capital (R&D in particular) and direction of resources to sectors lacking in pertinence in terms of preparation for the future (real estate in particular).

Gross fixed capital formation in the manufacturing sector (in volume)

Summary: Has There Been an Investment Gap in France and Europe since 2007?

- The Fall in Investment in the Eurozone since 2007

- Slower Growth of Investment in Ict and R&D

- Investment in Public Infrastructure Falling in the South of the Eurozone

- Authors: Fabien Dell, Pierre Douillard, Lionel Janin and Nicolas Lorach, Sustainable Development, Economy and Finance Departments.