An increase in investment in Europe, as planned in the “Juncker package”, which provides for the mobilisation of 300 billion euros in investments, will have both a medium-term effect upon supply and a short-term effect upon demand, and therefore upon growth.

The choice of these investments needs to be guided by several objectives:

- selecting additional investments which would not have been implemented in the absence of European and national initiatives;

- avoiding projects with insufficient socioeconomic returns (of the “white elephant” kind, which prove more costly than beneficial) or based upon barely-stabilised technologies, which carry the risk of being imminently condemned to obsolescence;

- anticipating these investments when possible, that is to say to accelerate their implementation in order to obtain short-term effects for business (renovation and renewal of existing infrastructures for example).

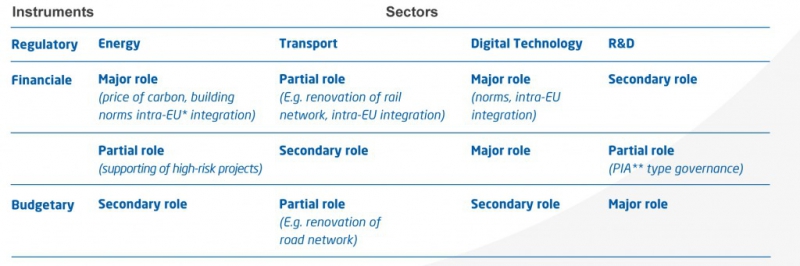

National and European authorities have several roles to play:

- ensuring a certain stability of the fiscal and regulatory framework: this will give greater visibility to investors and, by means of regulation, also enable improved planning of devaluation of capital stock, therefore facilitating its renewal;

- mobilising public debt funds, capital holdings and guarantees, in order to “activate” private resources that are afraid of excessively high levels of risk;

- putting appropriate European governance into place for the selection of future projects.

These conditions will open the possibility of moving from a situation in which reduction of State debts is synonymous with weak investment and weak growth, to one in which debt reduction is enabled by strong growth, catalysed by large, high-quality capital stocks.

What actions in which sectors?

Summary: The Levers of a European Investment Strategy

- Reconciling short and medium-term effects

- Breaking down the barrier of uncertainties

- Conditions for the carrying of residual risk by the european union member states

- Public investment, a condition for growth and debt reduction

Authors: Fabien Dell and Nicolas Lorach, Economy and Finance Department