There are two conceivable possibilities – that are not mutually exclusive and would likely be mutually reinforcing – to foster investment in the short run: France can act alone or it can spearhead a wider European-level public investment plan. Given France’s high level of public debt and its commitments under the Stability and

Growth Pact, the first option would be achieved by changing the composition of public spending, improving the quality of investments and public guarantee mechanisms or strengthening the ongoing Future Investment Programme (PIA). A more ambitious European-wide investment package would be based on an additional budget within the framework of a new investment initiative or a dedicated European borrowing facility.

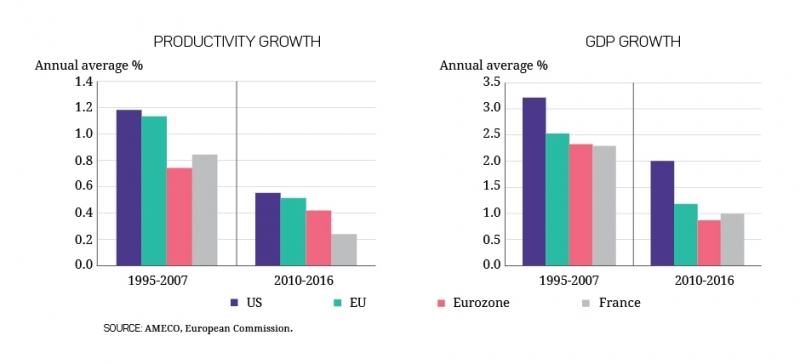

Eight years after the end of the global financial crisis, the French economy continues to grow at a noticeably slower pace than the 2.3% average annual growth it recorded from 1995 to 2007. Today, many economists and international organizations fear hysteresis effects due to long-term unemployment and decreasing labour force participation and the decline of the stock of capital resulting from insufficient investment. This predicament, which isn’t specific to France, could become self-perpetuating and cause long-lasting damage to potential growth. This perspective is all the more worrying as it is compounded by weak productivity gains and lacklustre potential growth observed throughout advanced economies.[1] According to European Commission estimates, French potential growth fell from a pre-crisis average of near 2.0% to 0.9% more recently.

In reality this slowdown predates the economic crisis and concerns most advanced economies. It results first and foremost from supply-side problems, which limit the capability of French companies to take advantage of growth opportunities in world markets. Despite some improvement thanks to its Employment-Competitiveness Tax Credit (CICE, Crédit d’Impôt Compétitivité-Emploi), France’s cost-competitiveness has deteriorated, and its product quality range is suboptimal. What’s more, the country has lost international market share.[2] In the years since the crisis weak domestic demand has added to these supply-side factors. This is reflected in the fact that GDP remains below its potential level[3] and in the persistence of high cyclical unemployment.

Increased public investment would help to counter the supply-side problems hindering growth and buoy demand. The OECD and the IMF have recently called for such action,[4] warning against the risks of sustained economic stagnation. Furthermore, central bank easing has enabled many countries to borrow at extremely low rates.

Despite falling by almost 10% since 2008, at 3.4% of GDP public investment[5] in France, remains considerably higher than in Germany (2.2%), the UK (2.6%) and the EU (2.7%). Compared with other advanced economies, France is already equipped with relatively higher-quality infrastructure.[6] Given these initial starting conditions, the risk is that an increase in public investment would finance projects with low socio-economic returns.

For this reason, the challenge facing France is, first and foremost, that of selecting public investment projects that are likely to crowd-in private investment and improve productivity and potential growth in the long run without operating costs increasing future deficits. This calls for investing in the needs of the future, such as the energy transition (e.g. thermal insulation of buildings, clean urban transportation and electrical vehicle infrastructure), digital infrastructure, venture capital financing, higher education and research. Current expenditure items like funding for innovation, healthcare and education do not meet the national accounts definition for investment, yet they should be included because they are also likely to increase potential growth.

There is no reason for these investments to be financed by the public sector alone, but the public sector can act as a catalyst where market return is too low or the level of risk too high for the private sector to finance these investments projects without public support. For example, in the case of the energy transition, the public

sector has a key role to place given that the current environment of low oil prices and low carbon prices does not incentivize private investment in clean energy.

Faced with the need to support potential growth and prepare for the future, France must choose a direction for its broader investment strategy. The economic consensus on the use of fiscal policy in the context of stagnant economic activity is evolving in this regard.[7]

There are two possibilities for improving investment in the short term: (i) act alone and use the flexibility allowed in the current European framework; or (ii) spearhead a more ambitious investment plan at the European level alongside other EU member states.

1. See Jaubertie A. and Shimi L. (2016), “Où en est le débat sur la stagnation séculaire ?”, Trésor-Éco n°182.

2. For a full assessment, see Sode A. (2016), “Compétitivité : que reste-t-il à faire ?”, Enjeux 2017-2027, France Stratégie.

3. The output gap was about -1.4 percentage point in 2016 according to a European Commission estimate.

4. OECD (2016), “Using the Fiscal Levers to Escape the Low-Growth Trap”, Chapter 2, OECD Economic Outlook, Issue 2; IMF (2016), World Economic Outlook, October: “Subdued Demand, Symptoms and Remedies”.

5. In the sense of the national accounting definition, in other words gross fixed capital formation (the value of net acquisitions of new or existing tangible and intangible [e.g. patents] produced assets that are used repeatedly or continuously in other production processes, not taking into account the

depreciation of capital).

6. See Cour des Comptes (2015), “La situation et les perspectives des finances publiques” ; Douillard P., Janin L. and Lorach N. (2014), “Y a-t-il un retard d’investissement en France et en Europe depuis 2007 ?”, La Note d’analyse n°16, France Stratégie.

7. See Furman J. (2016), “The New View of Fiscal Policy and Its Applications,” mimeo.