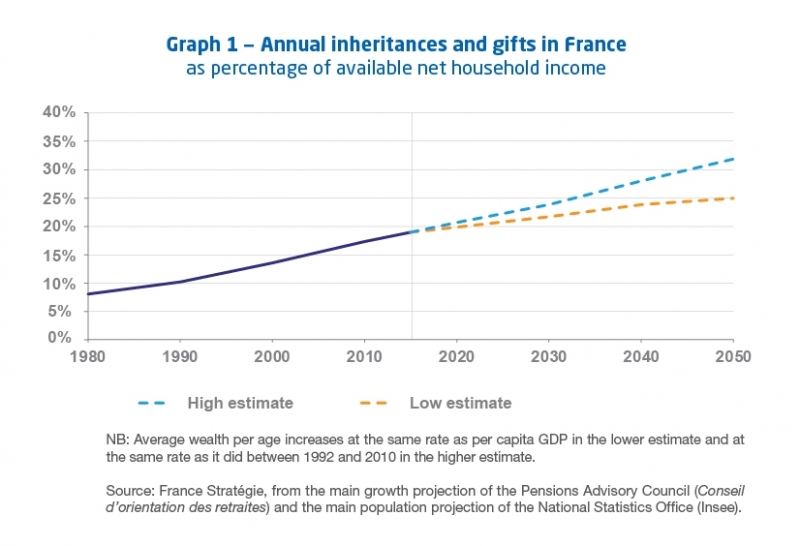

The value of private wealth owned by French households rose significantly from the mid-90s to the mid-2000s. And at the same time the gap in wealth held by di erent generations widened, reinforcing the dominant position of those over 50. Sluggish growth means these factors are likely to favour the emergence of a society where inherited wealth determines an individual’s path more than wealth earned through work.

Taxation can be used to correct for inequality of opportunity and prevent the emergence of a minority privileged class that inherits wealth at an advanced age. Despite the fact that France has had a progressive inheritance tax since the beginning of the 20th century, it hasn’t been able to limit private wealth inequality and is ill-adapted to the challenges of the 21st century.

This note proposes thoroughly reforming inheritance taxation and refashioning it from the heir’s point of view. Instead of the tax rate being determined by the amount inherited on each death, the state would consider all the inherited wealth an individual receives throughout the course of their lifetime when setting the tax rate. Moreover, to encourage grandparents to make gifts and bequests to their grandchildren, wealth received by relatively young heirs would be taxed at a lower rate than that received by older heirs.

Of course, these measures would only a ect individuals born to families with wealth to pass on. To redress this inequality, France could develop an additional system of capital endowments at adulthood, which could be financed by inheritance taxes.

La Note d’analyse is published under the editorial responsability

of the Commissioner-general for policy planning.

The opinions expressed are those of their authors.

Click here to subscribe to our newsletter, In Brief