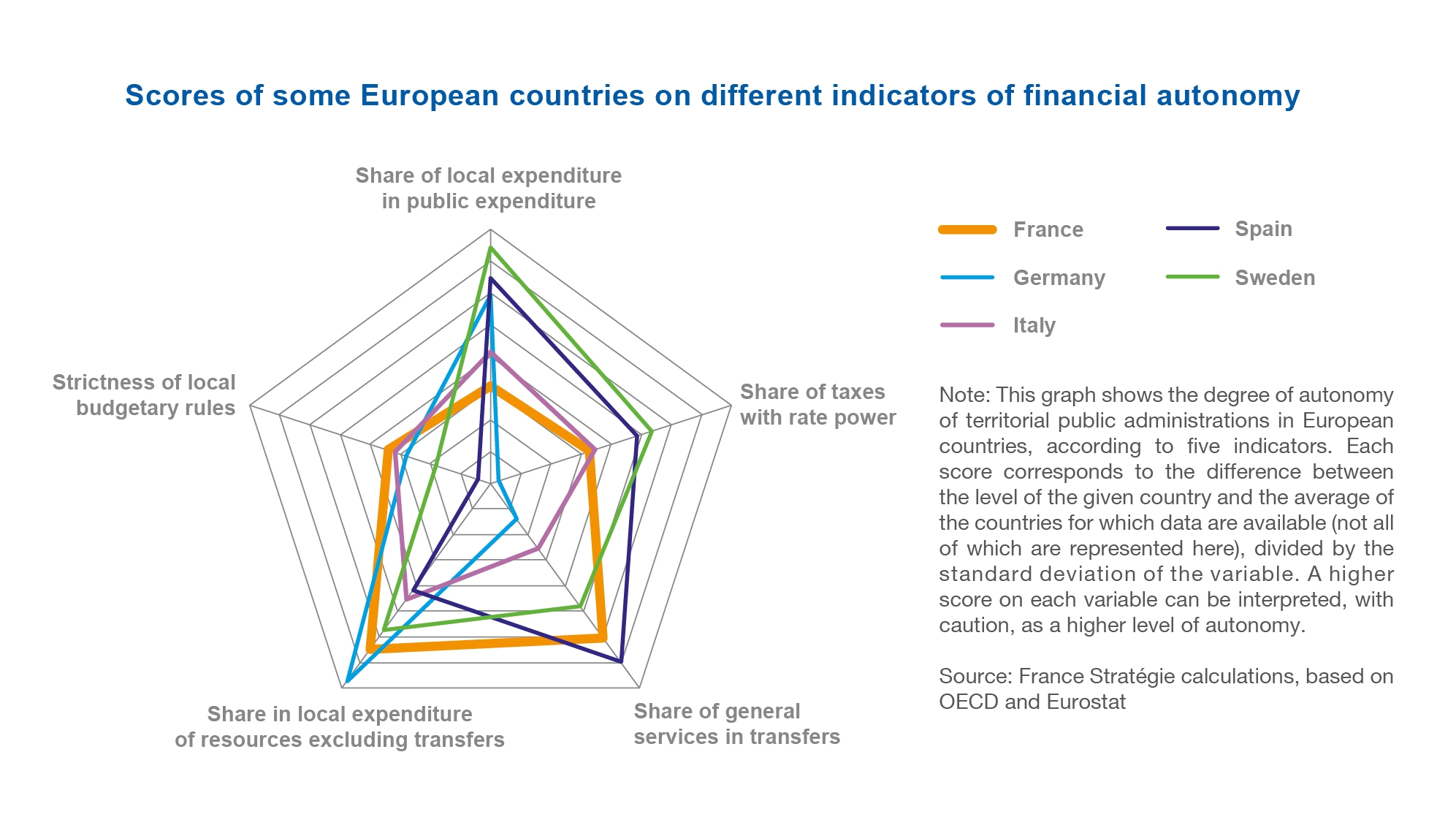

This observation must be qualified as regards public investment, as French territorial administrations play a significant role in its financing. In addition, the share of local expenditure in total public expenditure is an imperfect indicator of the degree of decentralization: the payer is not always the one who decides.

France is less singular in terms of the distribution of territorial administrations' resources. The share of tax revenues is slightly higher than in other countries and the share of government transfers is slightly lower. Is this a sign of greater autonomy for territorial administrations? Not necessarily, because the real power of territorial administrations over these revenues can vary significantly. For instance, government transfers are more largely flat-rate in France than in other countries, where they are often directed towards specific policies. In this respect, French local authorities would therefore be more autonomous. As for tax revenues, they seem less autonomous than in federal countries but as autonomous as other countries.

The borrowing capacity of local and regional governments is limited by budgetary rules in most European countries. The French golden rule - that borrowing should finance investment and not operating costs - is no more restrictive than the budgetary rules imposed on the territorial administrations of other countries. However, it appears to be more effective since French local authorities are less indebted than elsewhere.

Overall, although the decentralization of public expenditure appears to be low in France, the resources of local authorities give them a degree of management autonomy that is no less than that of other European countries.

On 25 April 2019, at the end of the Great National Debate, the President of the Republic declared that he wanted to open a "new act of decentralization" covering, in particular, housing, transport, and ecological transition. In addition, the abolition of the residence tax on all primary residences calls for a review of the financing of local authorities.

The purpose of this note is to inform the discussions that these reforms will raise. Is public spending more decentralized in other European countries than in France? How are local and regional authorities financed? Is there a French specificity in this matter? The first part examines the expenditure of local and regional authorities in the European Union and the second part examines their resources.